Trust in P2P Economy

HomeAway

Summary:

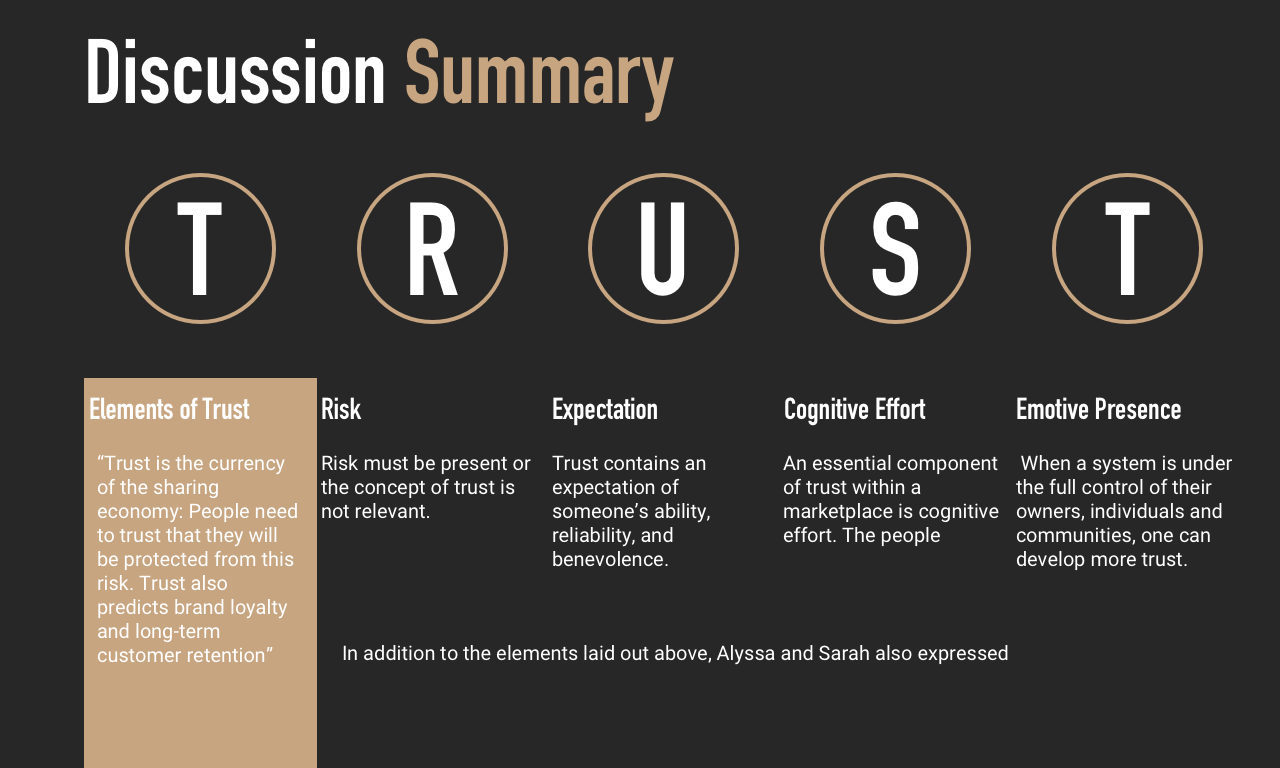

Trust is the currency of the sharing economy.

This research study focused on stimulating trust through the user interface from the traveler’s perspective. Zeroing in on the interface itself provided opportunity for us to supply direct actionables along with top-level findings.

Problem Space:

For sharing economy, trust is one of the most important factors that influence our digital experience through products since we humans have complex psychological reactions to the interfaces they encounter, and those reactions dictate how they feel about the products, experiences, and entities with which they interact. Trust is the “willingness to rely on another in the face of risk.” People need to trust that they will be protected from the risks. Trust also predicts brand loyalty and long-term customer retention.

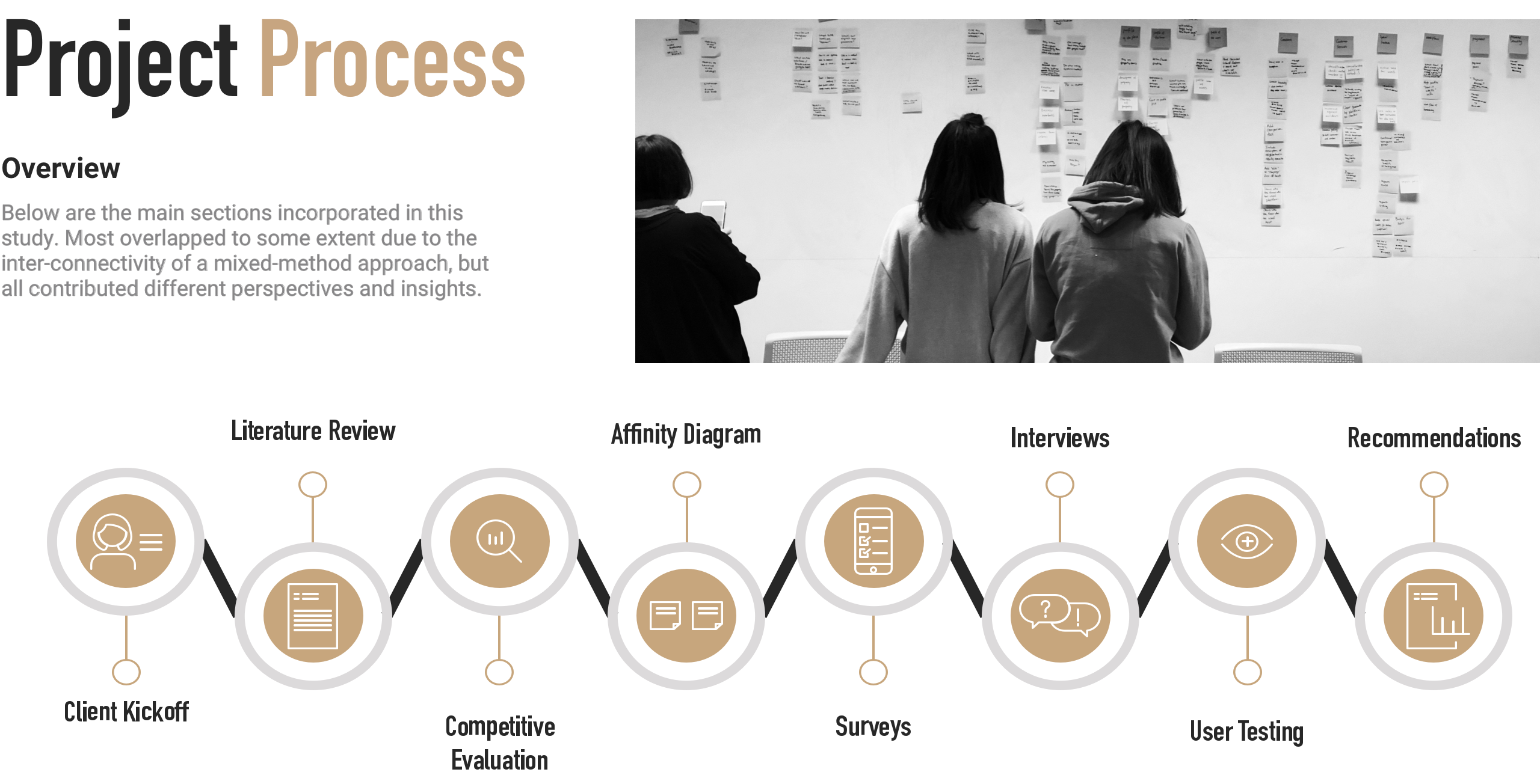

How I do:

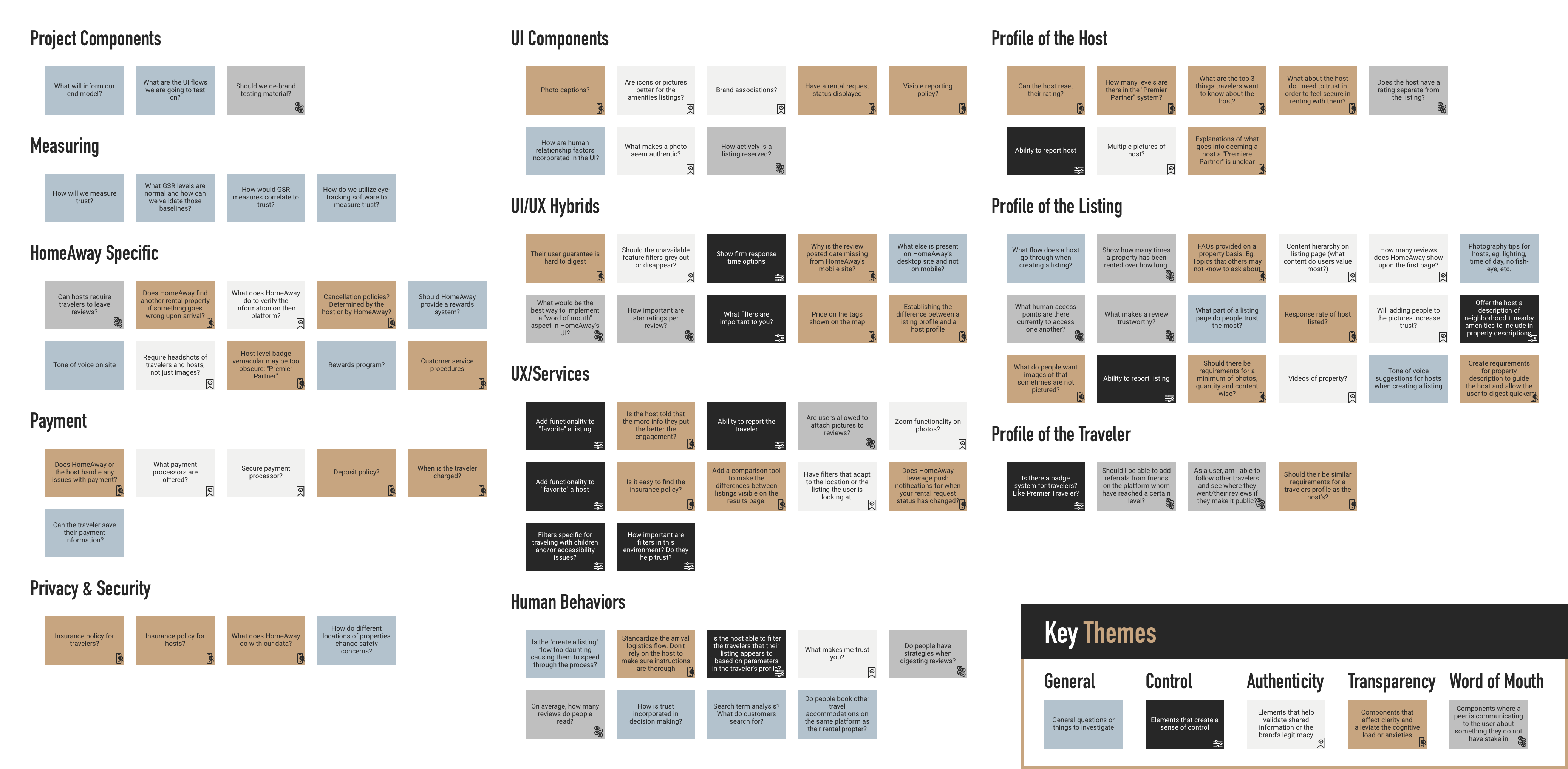

We reviewed past academic and industry literature in order to better understand the concept of trust both independently and with respect to the P2P market. From affinity diagram exercise, four themes kept arising the topic of trust; control, authenticity, transparency, and word of mouth. Our competitive evaluation helped provide a baseline of must-haves in relation to user expectations due to their presence within competing products. The survey provided data for comparing 3 sharing markets side-by-side; home-sharing, ride-sharing, and the P2P resale market which decompose any points of anxiety or feeling of heightened risk. At last, performing moderated user testing incorporating eye-tracking software and interview methods in order to test hypotheses built by the results of the previous research methods.

My Role:

Affinity diagram, Literature review, 1-1 interviews, Usability Testing - Eye Tracking

Tools:

Sketch, Qualtrics, Tobii

What I learn:

During the study, I've learned how to use, analyze eye tracking data and create heatmap to see what users are looking at when they enter the website. Meanwhile, I recognize the pros and cons of this methodology. For example, "think aloud" protocol may not be a suitable method during testing since we want to see users' actual eye movement without giving other distraction or intention to look at specific features. However, eye tracking is a great tool when you try to find out what draws people's attention and how their eyeballs move from place to place when they visit a website.

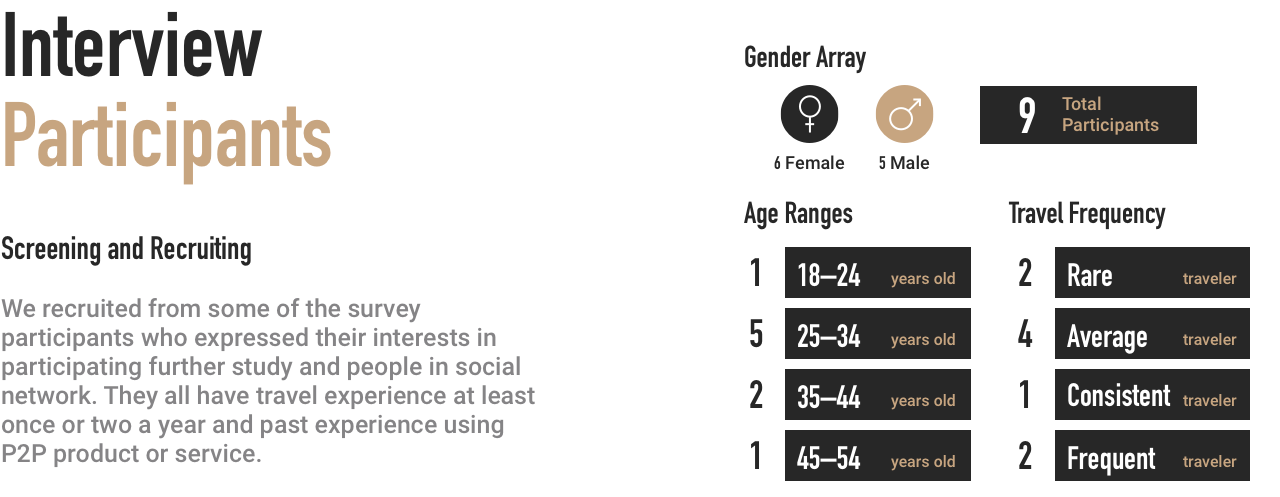

We created the survey with Qualtrics and advertised it via student listservs, social media (Linkedin, Facebook, Twitter), and word of mouth. We designed the survey in a way that screened for only those respondents who had participated in one or more of three types of P2P marketplace: ride-sharing, online selling, or home sharing.

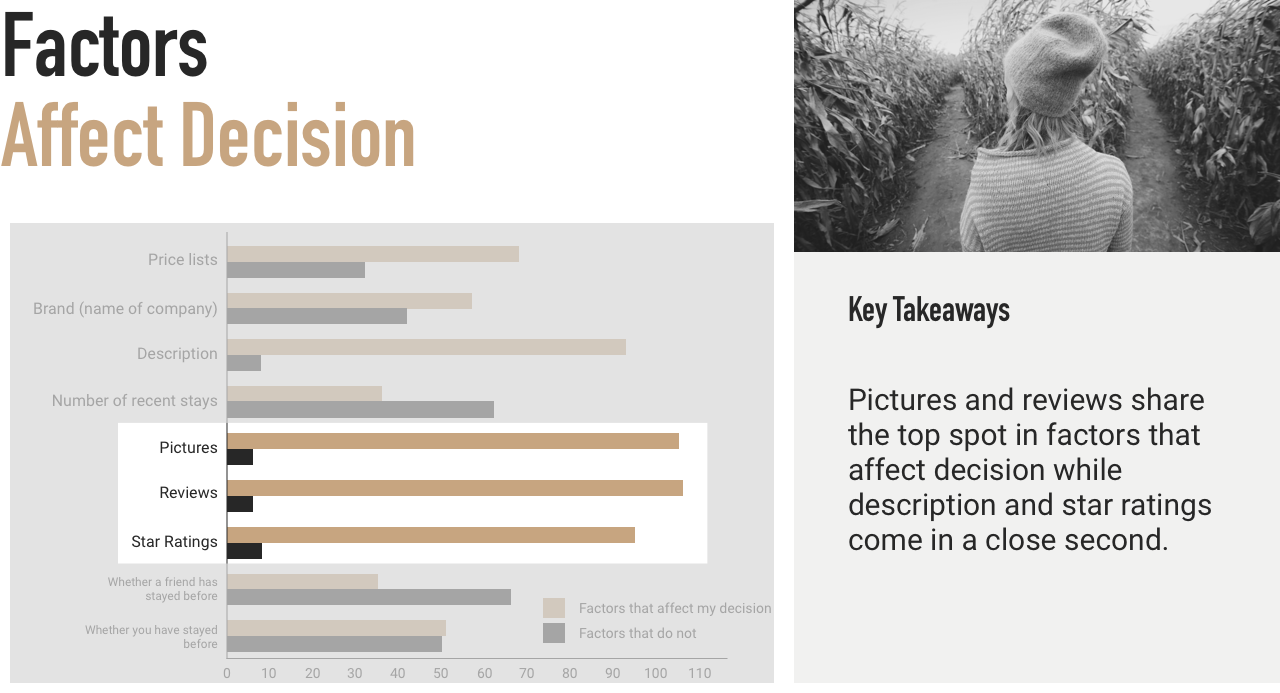

Participants were asked to perform the same sorting task in relation to factors that affect their decision when they view specific places on a website or in an app.

For the interview, we dug deeper into people’s behavior on travelling to decompose the process of what point they feel insecure in response to four key factors and why that we explored from previous studies and to further explore the underlying influence between different weighted of elements regarding booking a place to stay. We also looked into people’s experiences towards different p2p marketplace to try to explore more factors that can be considered into increase the level of trust. This helped us further uncover the factors and UI elements we intended to test for eye tracking user testing.

Utilizing the results from the previous phases, we designed modified versions of the HomeAway traveler flow for user testing material. We used equipment in the School of Information’s Information Experience (IX) Lab (Tobii Pro eye-tracking platform and iMotions biometric research software) to conduct moderated user testing and interviews. As noted previously, we employed volunteers from our peer groups as participants.

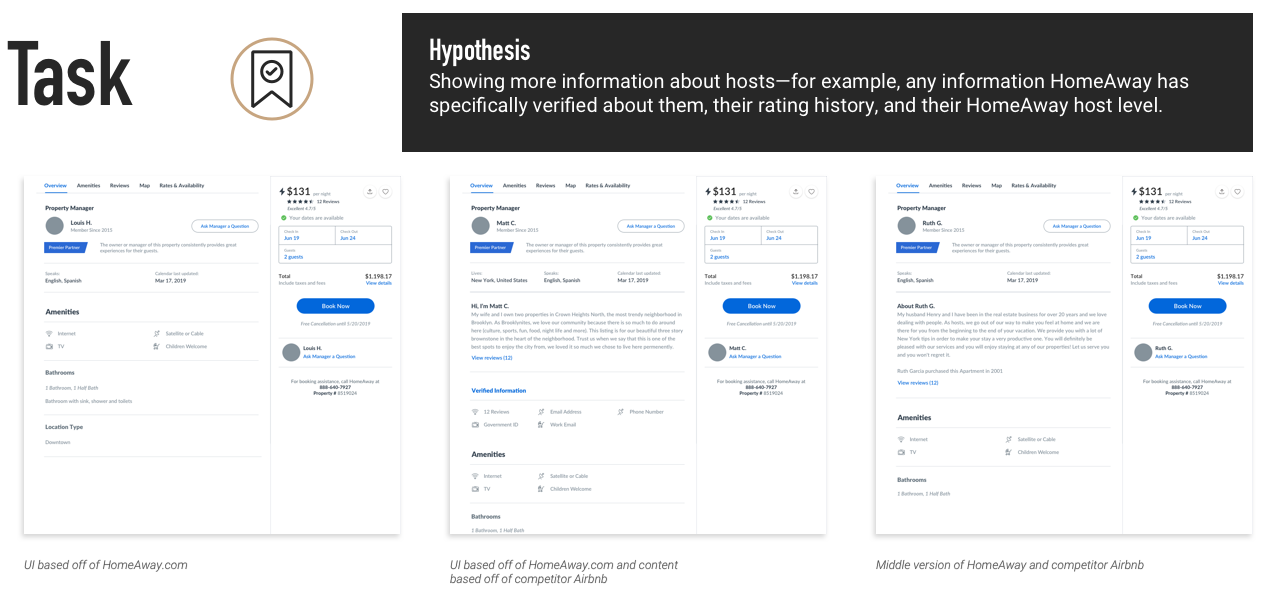

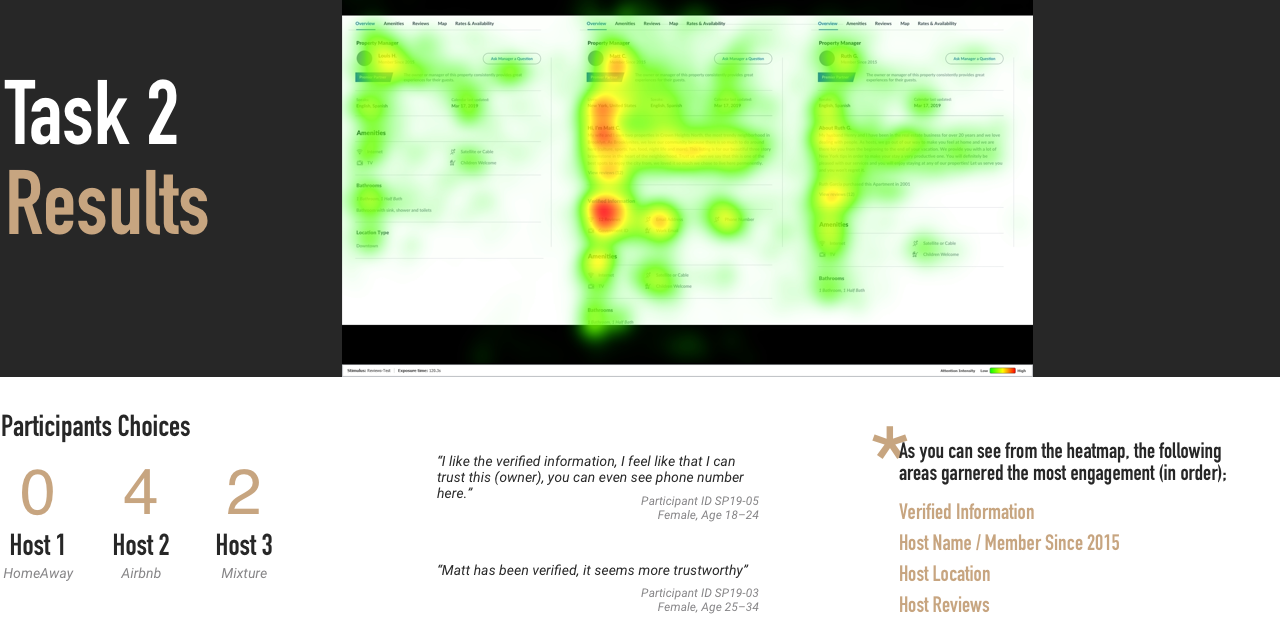

Users consistently chose the host with the most information displayed. None of the 6 participants chose the host option based off of the current HomeAway UI. Instead, 4 chose Host 2 based off of what information Airbnb supplies and 2 chose Host 3.

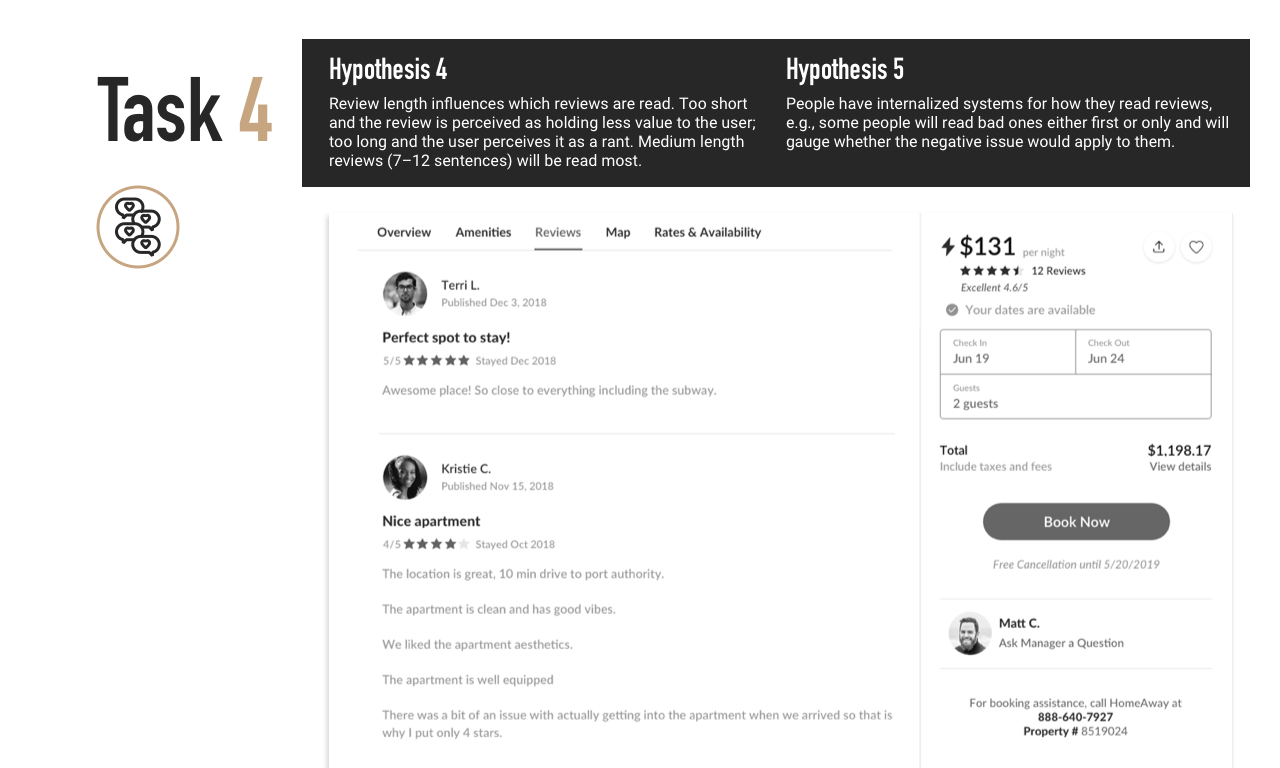

The desire for detailed and focused accounts from reviewers trended again across research methods.

- 91% of survey respondents rated reviews as one of the top two decision-making factors (equal to pictures).

- From the user interviews, one of the participants articulated, “I chose him because he talks about the experience of the house itself. Some other people’s long reviews about how great their trip experience are not that helpful and I’m not interested in that.” –Participant SP19-05

- During user testing, 4/6 participants chose to book with the host whose profile contained the most information.

Currently, HomeAway’s policies, verifying tactics, provider badge vernacular definitions, and general explanatory content are not easily accessible from a usability standpoint. At the same time, according to our survey results, 60% of respondents listed guarantees as a reason they use Airbnb most often for home-sharing rentals.

In our survey, compared to the ride-sharing and online-selling markets, which both have key worrisome phases, the home-sharing market showed an even distribution (approximately 30%) of anxiety across all phases of the home-sharing experience.